Case studies

Case studies

Case Study

PROSPECT:

LOCATION:

CLIENT:

ENGAGEMENT:

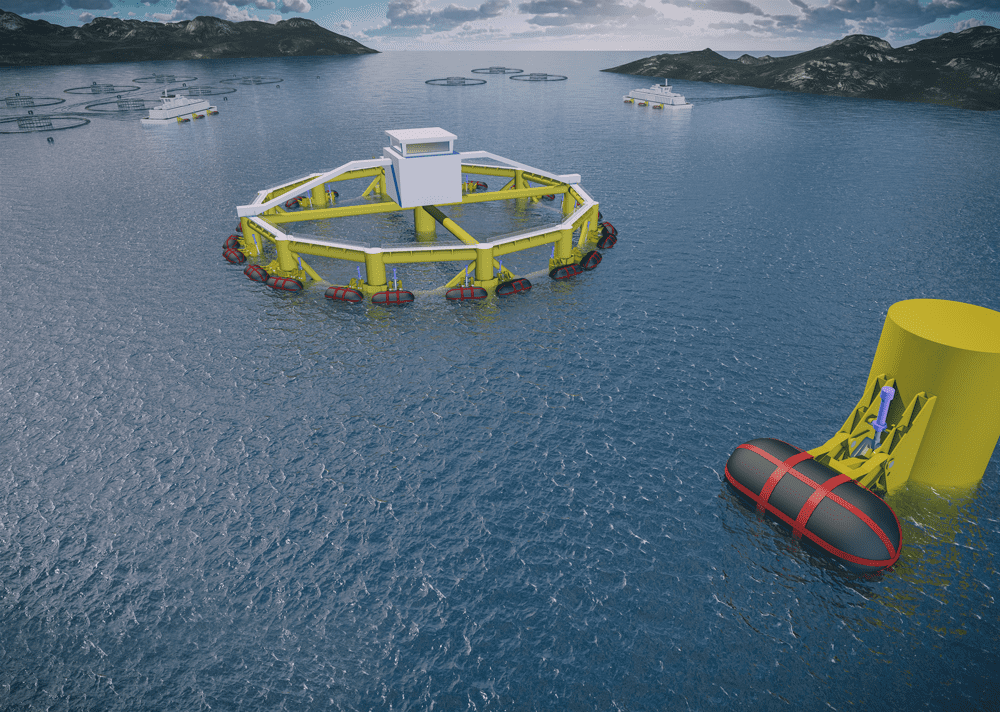

Mayfair identified ZOEX and the front-end development work of the wave energy device concept and applications as a potential opportunity to increase the options in the Renewable Energy sector. Discussions with the client resulted in several months of front-end re-appraisal of the device and the technical challenges associated with wave energy and its overall viability within the auxiliary power requirements on near shore deployment and use. In parallel they have developed a clear pathway to market and have established direct cooperation with a range of Aquaculture companies who are in the process of transitioning from traditional diesel supplied auxiliary power to sustainable sources. The market exists and the challenge now is to develop the product. We are now fully engaged with a focus to promote this opportunity to the energy investment community.

Status: Actively seeking funding and preparation of pathway to proof of concept.

Case Study

PROSPECT:

LOCATION:

CLIENT:

ENGAGEMENT:

Current status: Prospect evaluation, develop concept integration and funding pathway options.

Case Study

PROSPECT:

LOCATION:

CLIENT:

ENGAGEMENT:

Current status: Initial stage FID discussions ongoing.

Case Study

PROSPECT:

LOCATION:

CLIENT:

ENGAGEMENT:

Development Scheme Review

Current status: Development planning suspended pending the classification of hydrocarbon volumes.